Project Billing

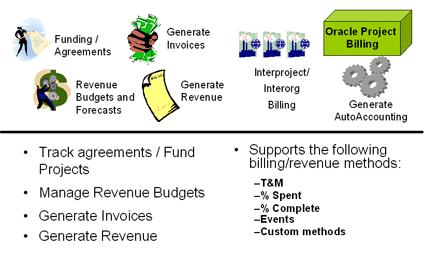

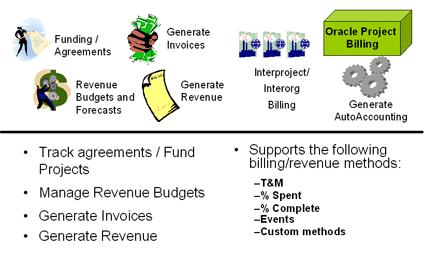

Oracle Project Billing provides you with the ability to generate revenue & create invoices for your contract projects. It integrates with other Oracle Applications to process revenue and invoices.

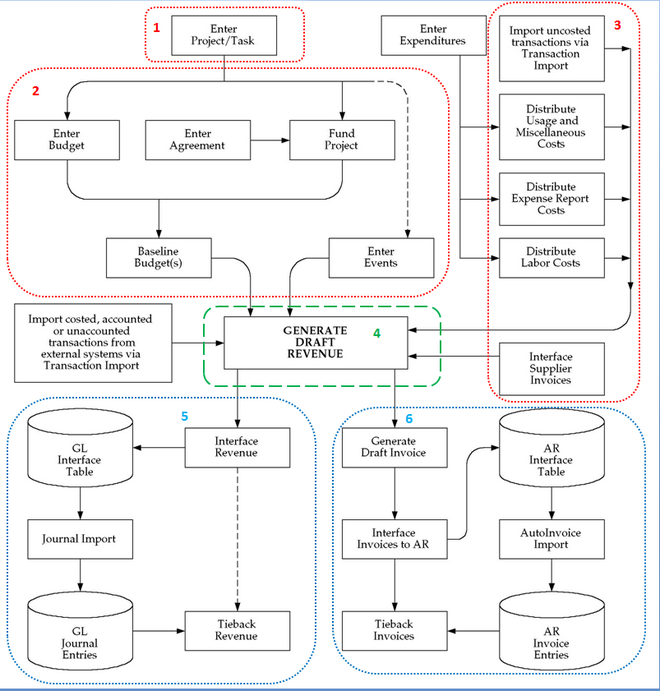

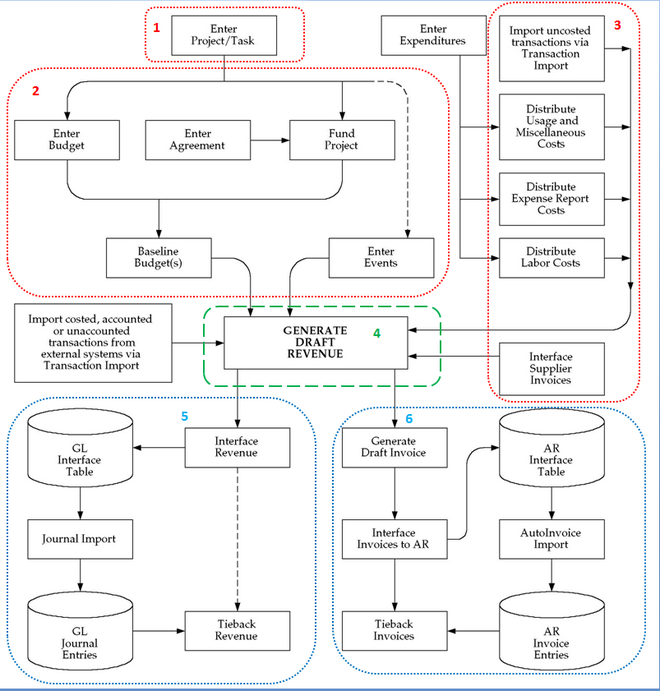

A standard oracle project billing cycle consists of following steps.

- Create a project. Enter project customers and contacts with whom you have negotiated and contracted project work. Enter the project billing methods.

- Enter agreements (contracts) from your customers and fund projects with those agreements.

- Generate revenue using various methods including time and materials, percent complete, and cost plus.

- Create draft invoices from detail transactions and milestones for online approval by your project or accounting managers.

- Interface revenue to Oracle General Ledger and invoices to Oracle Receivables while maintaining a detail audit trail.

- Report project revenue, invoice, and receivables status online and in reports.

Billing Options for Projects and Tasks

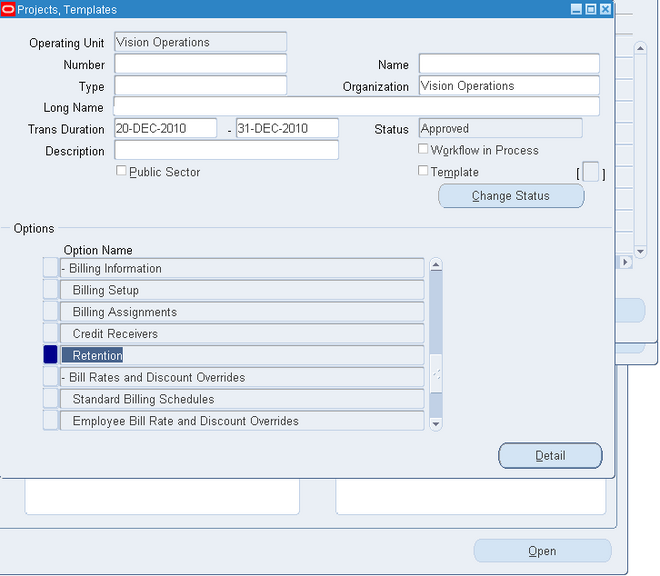

You specify project and task options to control how Oracle Project Billing processes your transactions. Use the Options region in the Projects, Templates window to specify the billing options for your projects and tasks:

The following table lists the billing options you can specify for your project and tasks:

Accounting Transactions

Oracle Project Billing allows you to generate draft invoices and draft revenue using separate processes, which you can run at different times. To allow for different billing cycles and revenue accrual, the distribution lines for General Ledger are created during invoice and revenue generation.

During the Generate Draft Invoices process, the account that is credited with the invoice amount is either the unbilled receivables (UBR) account or the unearned revenue (UER) account, depending on whether you accrue revenue before or after you generate invoices.

Overview of Contract Projects

You use contract projects to track activities, cost, revenue, and billing for services performed for and reimbursed by a customer. Types of contract projects include:

- Time and Materials

- Fixed Price

- Cost Plus

Entering a Contract Project

A contract project is the primary billing unit at which you specify the following information:

- Revenue accrual method

- Billing Details : Billing method, Billing cycle, Other billing information

For contract projects, you define additional information for revenue accrual and billing based on requirements of your project, your company, and your customer. For example, you can enter billing terms, bill rates and billing titles, status, and credit receivers for contract projects only.

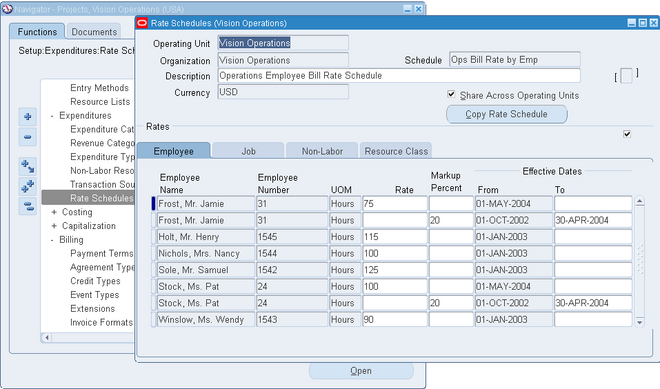

Billing Rates

A bill rate is an amount or percentage that is applied to a unit (of time and materials) to calculate revenue and invoicing. Bill rates are used for time and materials projects. You can specify the following bill rates in Oracle Projects:

- Employee Bill Rates: Standard hourly bill rates or percentage markups assigned to employees. You can assign a different bill rate to each employee for customer invoicing.

- Job Bill Rates: Standard hourly bill rates assigned by job title. For example, all System Administrators can have one bill rate, while all Consultants can have a different bill rate.

- Non–Labor Bill Rates: Standard bill rates or standard markups assigned to non–labor expenditure type or non–labor resources.

You can use the different types of rate schedules for various purposes in Oracle Projects:

- Costing: Use cost rate schedules to maintain hourly cost rates for employees or jobs. You can use both the employee and job rate schedule types as cost rate schedules.

- Billing: Use bill rate schedules to maintain the rates and percentage markups over cost that you charge clients for your labor and non-labor expenditures. You can also use bill rate schedules in transfer price rules to determine how Oracle Projects calculates the transfer price for cross charged expenditures. You can use the employee, job, and non-labor rate schedule types as bill rate schedules.

- Planning: Use either actual rates or planning rate schedules to determine rates for workplan and financial planning. All four rate schedule types can be used as planning rate schedules.

You can define or copy rate schedules for your entire organization. You can also define or copy separate schedules for individual business units.

Use a naming convention to distinguish between the different uses for rate schedules. No system attribute is available to distinguish among the uses.

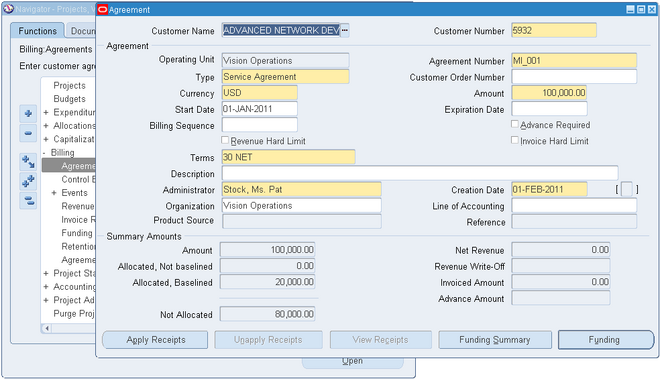

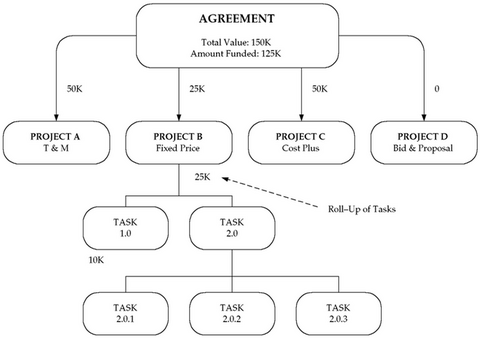

Agreements and Project Funding

In Oracle Projects, an agreement represents any form of contract, written or verbal, between you and one of your customers. For example, an agreement may correspond to a purchase order, a continuing service agreement, or a verbal authorization.

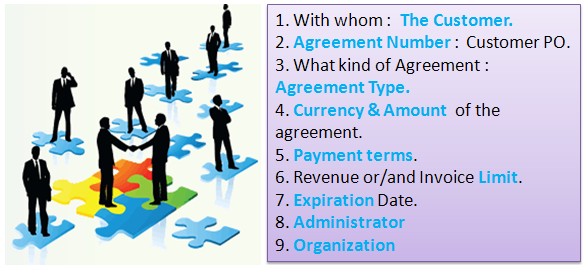

An agreement provides the funding for projects and tasks. Each agreement you define includes the following items:

- A customer

- A hard or a soft limit for revenue and/or invoice

- A currency amount

- An organization that owns the agreement

If you specify a hard revenue and invoice limit on an agreement, Oracle Projects prevents revenue accrual and billing activity beyond the amount you funded to a particular project or task. If you specify a soft revenue and invoice limit, Oracle Projects provides a warning telling you when revenue and billing for the project exceeds the amount you funded.

Note: You can specify a hard limit for both revenue and invoice limit, or a hard limit for revenue or invoice limit.

No project or task can accrue revenue without an agreement to fund its revenue budget.

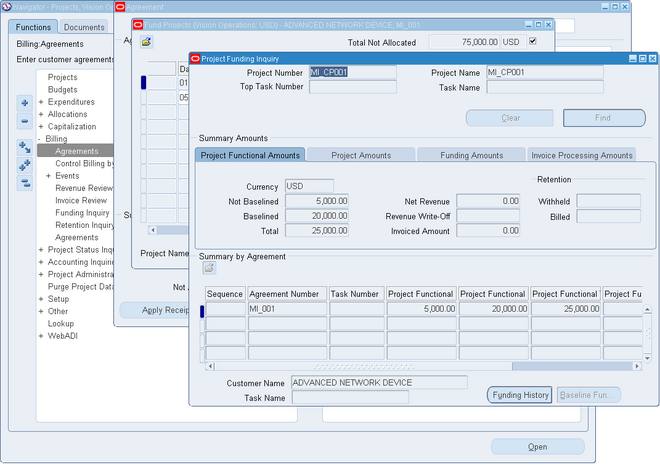

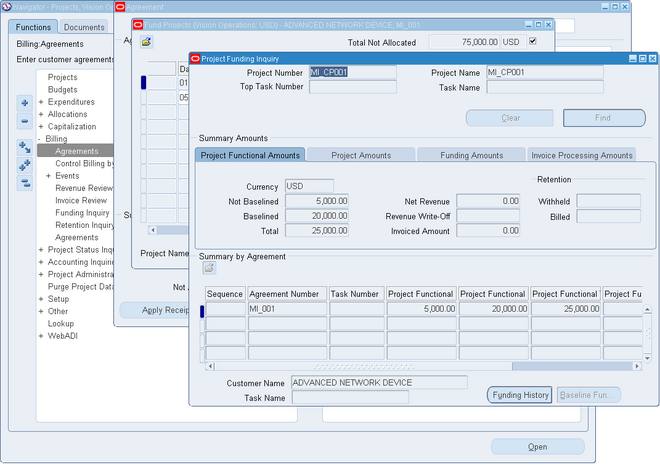

From the Agreements window, you can open the Funding window to allocate funds to one or more projects (or to top tasks within a project), and to see how much unused funding remains for an agreement. Each agreement that funds a project can be entered in a different currency.

For any agreement, you can review the revenue and billing activity associated with the agreement, such as the amount of revenue accrued, the amount invoiced, and the amount of funding that is allocated and has a baseline.

All revenue and invoices in Oracle Projects are recorded against an agreement, and all items that accrue revenue against an agreement subsequently bill against the same agreement.

Important Fields

1. Customer : Enter the Customer who is providing the agreement funding.

2. Agreement Number : Enter a Number to identify this agreement, such as the customer’s purchase order number.

The agreement number must be unique for this customer and agreement type, although two customers can each have an agreement with an identical agreement number.

Attention: You cannot change this number once you create an invoice against this agreement and interface the invoice to Oracle Receivables.

3. Agreement Type : Enter an agreement Type.

4. Currency & Amount : Choose the currency code of the agreement from the list of values. The list of values is restricted to the currencies defined in Oracle General Ledger.

Note: The currency field can only be updated if the Multi Currency Billing implementation option is enabled at the operating unit and the funds have not been allocated.

Enter the Amount of this agreement.

5. Payment terms : Enter the payment terms (defined in Oracle Receivables) for any invoices funded by this agreement.

6. Revenue or/and Invoice Limit : Choose the Revenue Hard Limit or/and Invoice Hard Limit check box to impose a hard limit on revenue accrual and invoice generation for projects funded by this agreement. Otherwise, Oracle Projects imposes a soft limit.

A hard limit prevents revenue accrual and invoice generation beyond the amount allocated to a project or task by this agreement.

A soft limit issues a warning when revenue accrual and invoice generation exceed the amount allocated to a project or task.

7. Expiration Date : Enter the date this agreement expires. If you do not want to enforce an expiration date, leave this field blank.

If you generate draft revenue or an invoice for projects funded by this agreement after the agreement expiration date, Oracle Projects creates distribution warnings for revenue and invoices.

8. Administrator : Enter the administrator of this agreement. An agreement administrator can be a future–dated employee. However, this is not recommended or likely, because agreement owners are almost always current employees.

9. Organization : Enter the name of the organization that owns the agreement.

Note: You can choose any project owning organization( in the project owning organization hierarchy assigned to the operating unit) as the organization that owns the agreement.

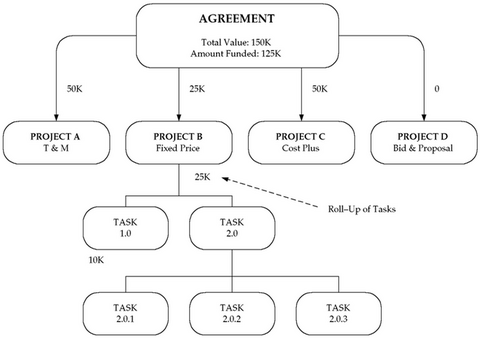

Project Funding

You must fund a project before the project can accrue revenue and be billed. Funding is the step that allocates an amount associated with a customer agreement to a specific project. The total amount of allocated project funding must equal the current approved project revenue budget amount in order to successfully baseline the project. Optionally, top tasks on projects can be individually funded. If top tasks are funded, then the same requirement of matching budget amounts to funding amounts applies at the top task level of the project.

In Oracle Projects, an agreement represents any form of contract, written or verbal, between you and one of your customers. For example, an agreement may correspond to a purchase order, a continuing service agreement, or a verbal authorization.

Fund Across Operating Units

You can fund different projects across operating units by enabling the Allow Funding Across Operating Units functionality in the Billing tab of the Implementation Options window.

Fund at the Project Level

There are many different ways to link agreements, projects and tasks. You should learn the benefits and consequences of each method to create clear policies.

One Customer, One Agreement

Use one agreement when you have one customer and one contract. This should be your most frequent case. All revenue is accrued and all invoices billed against the same agreement. The same agreement may fund other projects without changing the operation of the system.

Multiple Customers, One Agreement Per Customer

Use one agreement per customer when you have multiple paying customers, no additional contracts with any of the customers, and a requirement to invoice by contract.

All revenue and invoice amounts are divided between each customer according to the percentage splits defined for the project in the Customers and Contract Project options. Each run of generate revenue creates one draft revenue per customer, and each run of generate invoice creates one draft invoice per customer. The draft revenue and invoices for all customers contain the same items, but with prorated amounts. Oracle Projects supports only one percentage split between customers over the life of a project. You cannot change an existing percentage split.

One Customer, Multiple Agreements

Use multiple agreements when you have one customer, but several contracts, and a requirement to invoice by contract.

For example, a project that was originally funded by one purchase order is subsequently funded by another purchase order. The customer has requested that each invoice reference a specific purchase order. In this case, you would fund the project from two agreements, one for each purchase order. The PRC: Generate Draft Invoice process produces two invoices — one against each purchase order agreement from which funding is used.

When revenue is generated, hard limit agreements are used first in order of expiration date, followed by soft limit agreements in order of expiration date. When revenue fills one agreement and starts on the next, all of the items in the current revenue run are prorated between the two agreements.

Multiple Customers, Multiple Agreements Per Customer

Use multiple agreements per customer when you have multiple paying customers, multiple contracts with one or more of the customers, and a requirement to invoice by contract.

This method is a combination of the two above. Revenue is prorated between the customers according to their percentage split. For each customer, revenue is placed on agreements by the same rules as for multiple agreements and a single customer.

Fund at the Task Level

One Customer, One Agreement

Use one agreement when you have one customer and one contract. Use this method only if you want to accrue revenue cost–to–cost at the task level or impose hard or soft revenue limits at the task level. Task level funding with one agreement does NOT create separate task invoices. However, you can define an invoice format to group expenditure items by task.

Case Study: Funding for Hard Limits at the Task Level Fremont Corporation has a contract with XYZ Company for $100.000.

There are three phases to the project, each with a separate hard limit.

Each phase is set up as a top task, and funded with a hard revenue limit:

• Task 1: Design ($20,000)

• Task 2: Programming Services ($60,000)

• Task 3: QA/Testing ($20,000)

One Customer, Multiple Agreements

Use multiple agreements when you have one customer, but a requirement to create a separate invoice for each top task. You can use this method to accrue revenue cost–to–cost or impose hard or soft revenue limits by task, as well as automatically create separate invoices by task.

To create separate invoices by task, you must use a different agreement to fund each task. If you use more than one agreement for a single task, the agreements are used according to the precedence described earlier for projects.

For any agreement, you can review the revenue and billing activity associated with the agreement, such as the amount of revenue accrued, the amount invoiced, and the amount of funding that is allocated and has a baseline.

Events

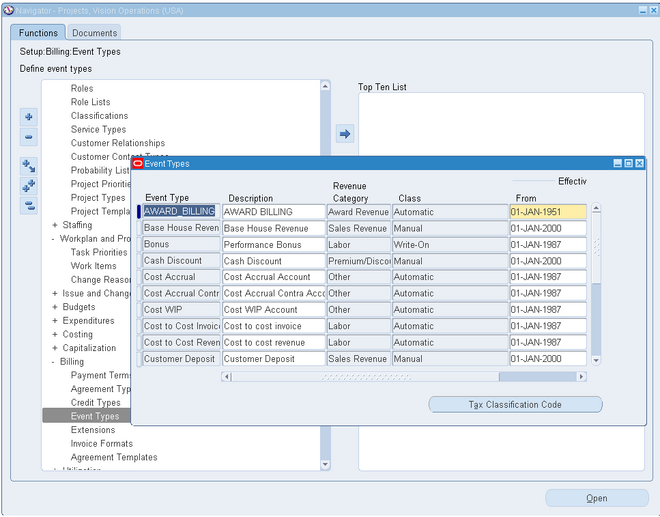

An event is an entry assigned to a top task or project that generates revenue and/or billing activity, but is not directly related to any expenditure items.

An event is an entry assigned to a top task or project that generates revenue and/or billing activity, but is not directly related to any expenditure items.

Unlike labor costs or other billable expenses, a bonus your business receives for completing a project ahead of schedule is not attributable to any expenditure item. In these cases, you use an event, rather than an expenditure item, to account for a bonus or other sum of money.

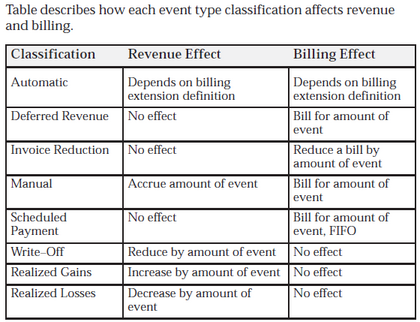

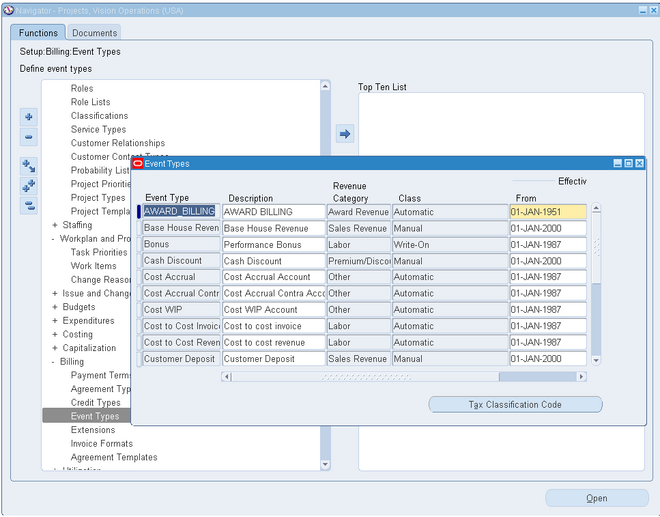

You classify events by event type. When you define an event type, you assign it one of the predefined classifications. When you enter an event, its event type classification determines how the event affects revenue and billing for a particular project.

You can define as many event types as you need, but you cannot create additional classifications.

Event Type. Enter a unique, descriptive name for this event type.

Revenue Category. Enter the revenue category that you want to associate with this event type.

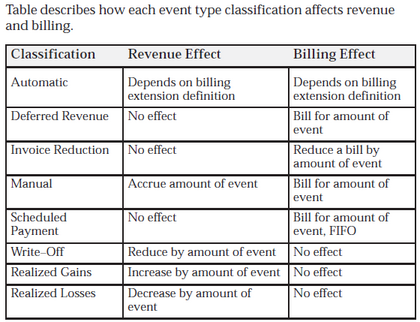

Class. Enter a classification for this event type to determine how an event affects the revenue and billing for a particular project. Oracle Projects provides you with the following classifications:

Automatic. An Automatic classification generates an automatic event for revenue or invoice amounts that may be positive or negative, depending on your implementation of billing

Deferred Revenue. A Deferred Revenue classification generates an invoice for the amount of the event, and has no immediate effect on revenue.

Invoice Reduction. An Invoice Reduction classification reduces the amount of an invoice without affecting revenue. For example, you can use an invoice reduction event to give a discount to a customer on a particular invoice.

Manual. A Manual classification allows you to enter both a revenue amount and a bill amount. These two amounts can be different. Classify an event type as manual when you need to indicate different revenue and bill amounts.

Scheduled Payment. A Scheduled Payment classification generates an invoice for the amount of the event. Oracle Projects marks expenditure items on the project being invoiced on a first–in first–out (FIFO) basis up to the amount of the event. When you use this classification, you can show details on an invoice even though the details are not used to calculate the bill amount.

Attention: The Scheduled Payment classification may be used only if the project uses Event based billing.

Write–On. A Write–On classification causes revenue to accrue for the amount of the write–on. A Write–On also adds the write–on amount to the subsequent invoice. Revenue and invoice amounts are identical. For example, when your business earns a bonus for completing a project on time or under budget, you can define an event type with the Write–On classification to account for the bonus amount. A write–on causes revenue to accrue and generates an invoice to bill your client for the bonus amount.

Write–Off. A Write–Off classification reduces revenue by the amount of the write–off.

Realized Gains A Realized Gain classification allows you to create an event to support reclassification of realized gains during funding revaluation.

Realized Loss A Realized Loss classification allows you to create an event to support reclassification of realized losses during funding revaluation

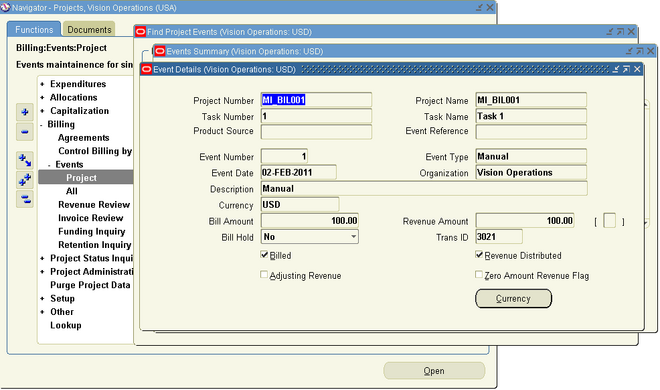

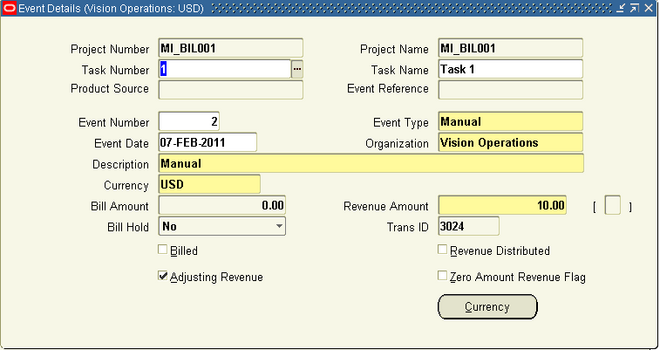

Creating Events

Use the Event Details window to enter and review events for a project or top task. Examples of events include an invoice reduction, a performance bonus, revenue write–off, or adjusting revenue. You can also change the bill hold status of an event using these windows. For transactions that involve foreign currencies, all amounts displayed in the Event windows are shown in the event transaction currency.

Use the Event Details window to enter and review events for a project or top task. Examples of events include an invoice reduction, a performance bonus, revenue write–off, or adjusting revenue. You can also change the bill hold status of an event using these windows. For transactions that involve foreign currencies, all amounts displayed in the Event windows are shown in the event transaction currency.

Events can be entered in any currency when multi–currency is enabled for the associated project. The currency in which the event is entered or created is called the event transaction currency. Oracle Projects uses the currency conversion attributes stored for each event to convert revenue and invoice amounts for manually entered and automatically created events from the event transaction currency to the project functional, project currency, and the funding currency.

Adjusting Revenue Events

You can enter adjusting revenue events when you enable the Adjusting Revenue checkbox in the Event Details window.

Note: The Adjusting Revenue checkbox can be enabled only for Manual Event Types.

Entering adjusting revenue events allows you to adjust revenue for a project without reopening the project ccounting period. Adjusting revenue amounts do not have an effect on invoicing. Therefore, you cannot enter a value in the Bill Amount field for these events.

After you have adjusted and regenerated revenue in Oracle Projects, submit the PRC: Interface Revenue to General Ledger process t o interface the adjusted revenue amounts to General Ledger.

Note: The revenue generation process assigns sequential revenue numbers to the draft revenue as it is generated. When adjusting events are entered for a project, a gap in numbering can occur when revenue is deleted and regenerated.

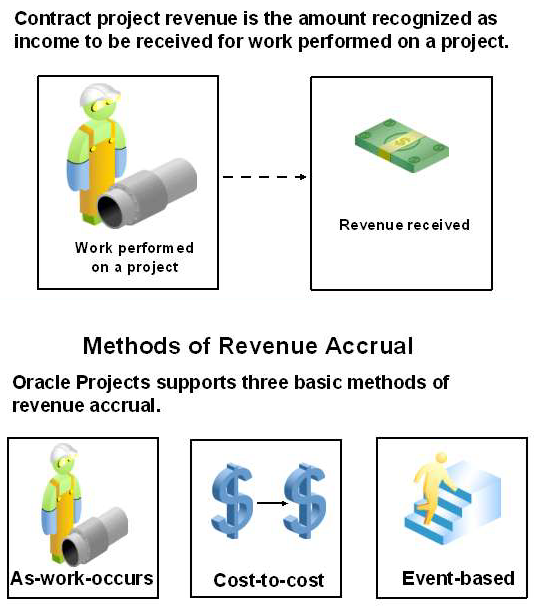

Project Revenue

Oracle Projects generates revenue based on the transactions that you charge to your projects. You configure your projects to accrue revenue based on your company policies. You can review revenue amounts online, and can also adjust transactions; these transactions are then processed by Oracle Projects to adjust the revenue amounts for your project. Oracle Projects interfaces the revenue amounts to Oracle General Ledger.

When you generate revenue, Oracle Projects calculates revenue, creates event and expenditure item revenue, determines GL account codings, and maintains funding balances. You can generate revenue for a range of projects or for a single project.

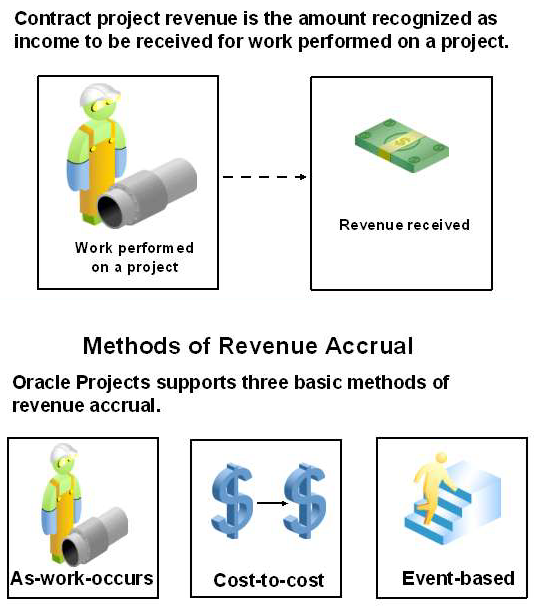

Methods of Revenue Accrual

Cost-to-cost

Based on the ratio of the actual costs to budgeted costs and revenue (referred to as percent

spent)

As-work-occurs

Based on bill rates or markups applied to detail transactions:

• Time and Materials (T&M) when using bill rates, or

• Cost plus when using burden schedules

Event-based

Based on the Oracle Projects client extensions calculations or direct user input from externally

calculated amounts; for example:

• Automated milestone creation

• Percent progress complete calculations

Accounting Dates and Review

How PA and GL dates are determined depends upon the transaction accounting method:

Period-End Date Accounting

- The PA date is set to the end date of the earliest PA period that includes or follows the revenue accrue through date and has a status of Open or Future.

- The GL date is set to the end date of the earliest GL period that includes or follows the PA date of the draft revenue and has a status of Open or Future according to the period status in Oracle General Ledger.

Expenditure Item Date Accounting

- The PA date is set to the revenue accrue through date if that date falls in a PA period with a status of Open or Future. If the revenue accrue through date falls in a closed PA period, then the PA date is set to the start date of the earliest open or future enterable PA period that follows the revenue accrue through date.

- The GL date is set to the revenue accrue through date if that date falls in a GL period with a status of Open or Future in Oracle Projects. If the revenue accrue through date falls in a closed GL period, then the GL date is set to the start date of the earliest open or future enterable GL period that follows the revenue accrue through date.

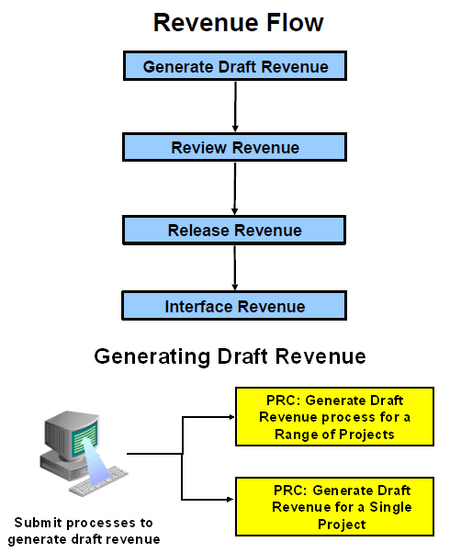

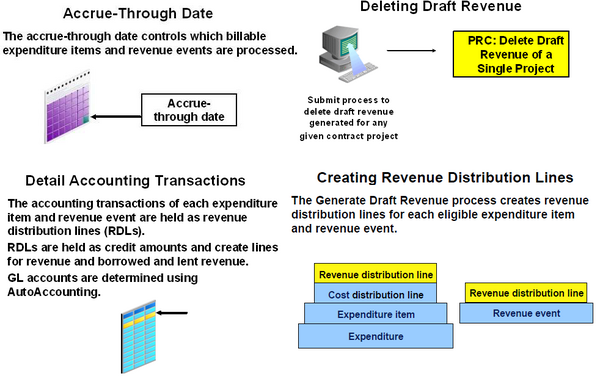

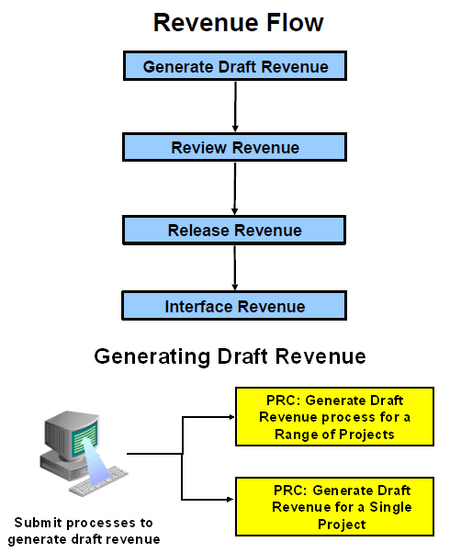

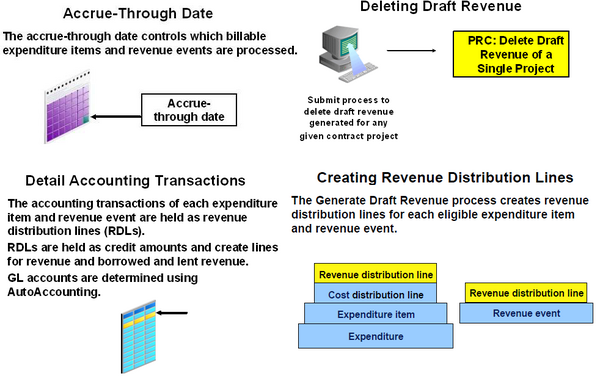

Generating and Adjusting Revenue

You can generate revenue for a single project, or for a range of projects using the PRC: Generate Draft Revenue process. You can also delete the revenue of a single project using the PRC: Delete Draft Revenue of a Single Project process. When you generate revenue, Oracle Projects first selects projects, tasks, and their associated events and expenditure items that are eligible for revenue generation.

Oracle Projects next calculates the potential revenue and then creates revenue events and expenditure items.Oracle Projects also calculates the bill amounts of each expenditure item, based on the revenue distribution rule associated with a particular project. When Oracle Projects creates revenue, it also searches for available funding for each revenue item. We discuss each of these topics in detail below after we tell you how to generate revenue.

Revenue Accrual and Invoicing

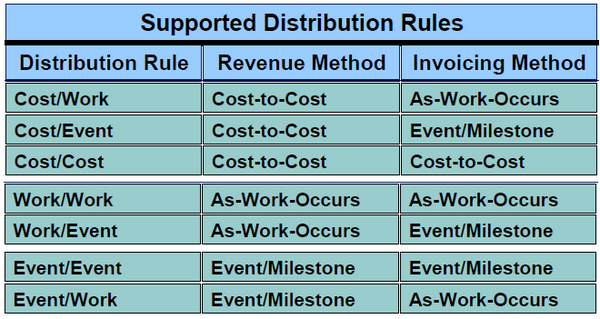

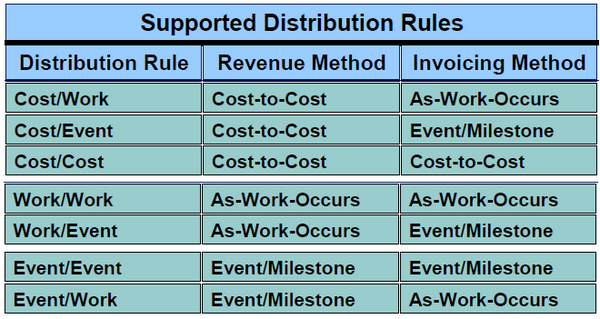

Generate Draft Revenue uses the overrides and schedules to process projects using As Work Occurs revenue accrual and/or invoicing. These projects are assigned one of the following distribution rules:

WORK/WORK, WORK/EVENT, EVENT/WORK.

Burden Schedules

Generate Draft Revenue follows the burden schedule precedence for items charged to tasks that use a burden schedule; it does not use bill rate overrides for these items.

Burden Schedules and Labor Multipliers

You may decide to use labor multipliers instead of a labor burden schedule if you are using a one tier multiplier for labor items. With a one tier labor multiplier, the use of labor multipliers and burden

schedule overrides for labor will result in same bill amounts but the method of processing will be different.

You can also use labor multipliers with a standard burden schedule for multiplier–tier revenue accrual and billing. This allows you to define one negotiated labor multiplier on top of the standard cost buildup provided by the standard burden schedule. The labor multiplier is

treated as another burden multiplier.

The calculation is: Bill Amount = Burdened Amount X (1 + Labor Multiplier)

You can also report this labor multiplier as another burden cost component in the PA_INV_BURDEN_DETAILS_LM_V view. The labor multiplier component is not displayed in the

PA_INV_BURDEN_DETAILS_V view.

Bill Rate Schedules

Generate Draft Revenue follows the standard bill rate precedence for items charged to tasks that use a bill rate schedule. This precedence includes employee bill rate overrides, job bill rate overrides, non–labor bill rate overrides, job assignment overrides, and task schedules.

Accrue-Through Date

You can specify the accrue-through date for revenue generation to control what items and

events are processed for revenue accrual.

• Billable items with an expenditure item date on or before the accrue-through date are processed.

• Revenue events with a date on or before the accrue-through date are processed.

Example

It is June 2, and you want to accrue revenue for the month of May.

You specify “31-MAY-XX” as the date through which to accrue revenue.

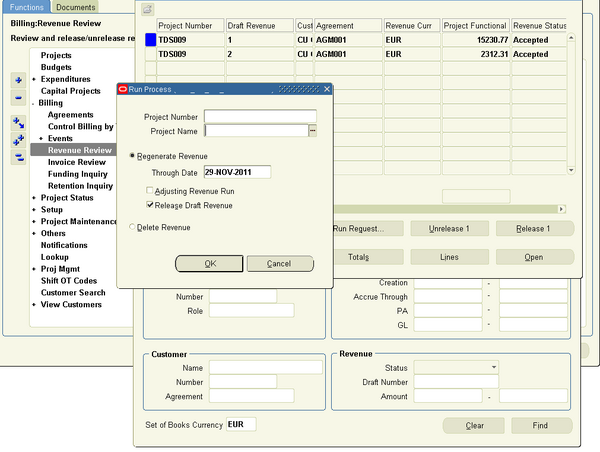

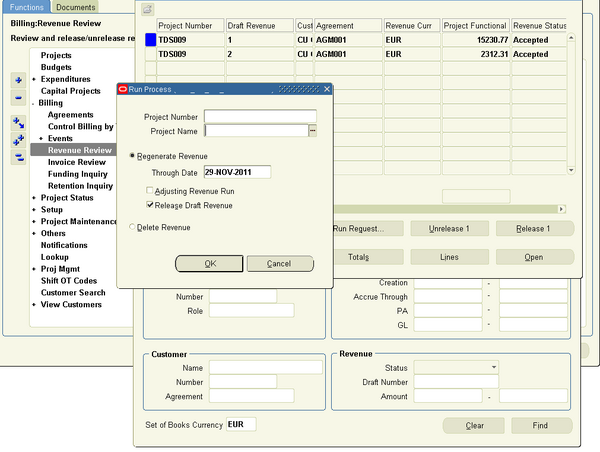

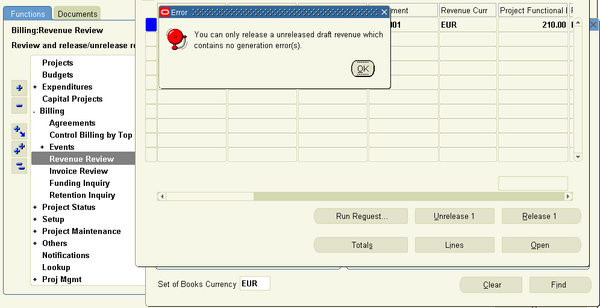

Reviewing Revenue

You can use the Revenue window to view all of the revenue information for a single draft

revenue in one window. Here, you can click the Run Request, Unrelease, Release, or Lines

buttons to:

• Regenerate or delete revenue for a project

• Change revenue status from released to unreleased

• Release unreleased revenue

In addition to the Revenue Summary information, the Revenue window displays the Released

Date field and the Warning check box. The Revenue window contains two alternative regions:

• Interface: Select this to review the status of revenue after you successfully interface it to Oracle General Ledger.

• Revenue Exceptions: Select this to view exception reasons and warnings encountered while generating draft revenue

Access to Revenue Review can be controlled by function security and project security. Function security can be used to control the release, unrelease, and run functions in Revenue Review..

Viewing Accounting Lines

You can see how a transaction will affect the account balances in your general ledger by viewing the detail accounting lines for the transaction as balanced accounting entries (debits equal credits) or T–accounts

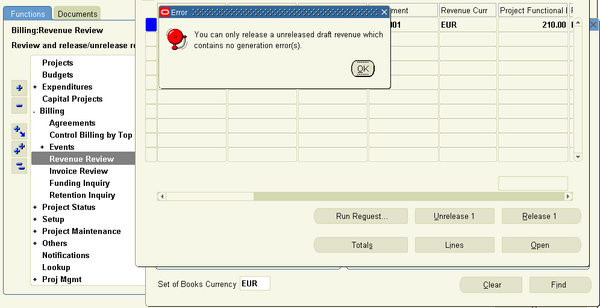

Release and Interface Revenue

Oracle Projects releases revenue to make it eligible for interface to Oracle General Ledger.

You cannot update or delete released revenue. Oracle Projects processes adjustments to released revenue by creating crediting revenue transactions.When you generate revenue for a range of projects, it has a status of Released.

Released revenue can interface to Oracle General Ledger when you run the Interface revenue process. When you generate revenue for a single project, it has a status Pending.

Releasing Revenue

Oracle Projects automatically releases revenue when you interface revenue to Oracle General Ledger in the Submit Request window. You can also release revenue manually using the Revenue Review window.

If you regenerate draft revenue for a single project, the process deletes any Pending draft

revenue and replaces it with the new amount.

When you release an invoice which is based on revenue details (such as a T & M invoice), Oracle Projects automatically releases the associated revenue. You use the Invoice Summary window to release an invoice.

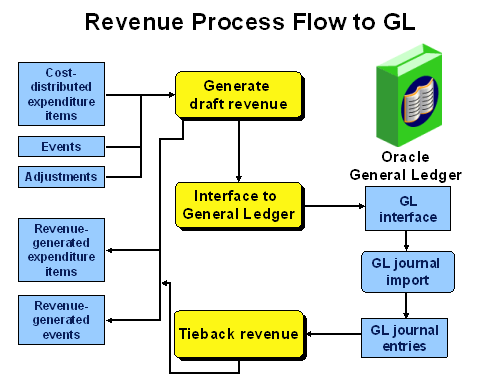

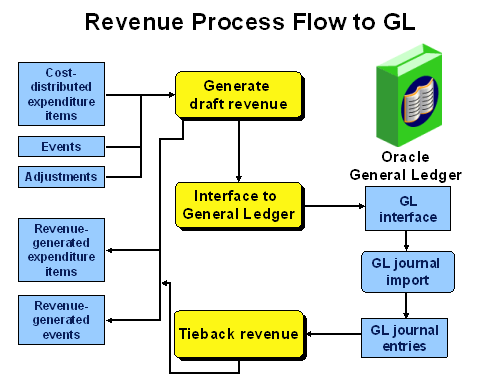

Interfacing Revenue

Oracle Projects fully integrates with Oracle General Ledger to update your general ledger accounts with your revenue transactions. You need to interface revenue with Oracle General Ledger using Oracle Projects processes. These processes interface and tieback revenue, maintain accounting balances and Unbilled Receivables and Unearned Revenue amounts.

Adjusting Revenue

Revenue is automatically adjusted when you adjust an invoice that bills the associated revenue. You can adjust draft revenue and draft invoices by adjusting expenditure items using the Expenditure Items window. For example, you can change the status of an expenditure item from billable to non-billable, or transfer an expenditure item to a different project from the one it is charged to.

Warning: You should make all revenue adjustments in Oracle Projects. You should not adjust project revenue in Oracle General Ledger, because the revenue amounts will not reconcile to the amounts in Oracle Projects.

You also can create revenue events to adjust the revenue amount associated with a project, independent of the expenditure items charged to the project. Revenue events have a classification of Write-On, Write-Off, Manual, or Automatic. You use the Events window to enter revenue events for projects or top tasks. The Events window is accessible from the Billing Information option.

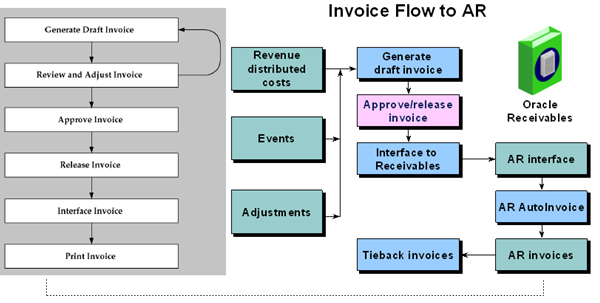

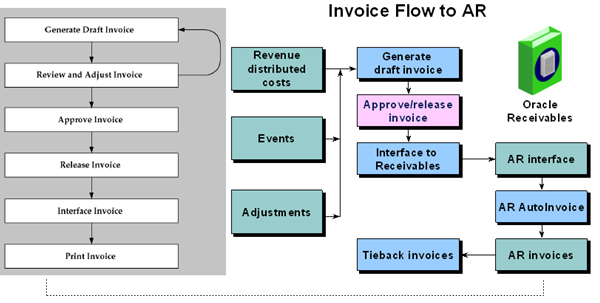

Invoicing

Using Oracle Projects features, you can manage and control your invoices, review and adjust them online, and review the detailed information that backs up your invoice amounts. When you generate invoices, Oracle Projects calculates bill amounts, creates formatted invoices for printing and posting, and maintains funding balances

Oracle Projects provides controls as to which projects are ready for invoice generation.

You must complete the following steps before generating invoices for a contract project in Oracle Projects:

1. Enter an agreement and fund the project, using the Enter Agreements window.

2. If you want to generate revenue or invoices for the project based on percent complete, enter percent complete information either at the project or the funding level (project or top task).

3. If you want the project customer to be billed in a currency other than the project functional currency, enter currency attributes for the project customer.

Note: To enter currency attributes, you must enable the multi–currency billing functionality.

4. If you are using multi–currency billing, enter project level currency conversion attributes.

5. Enter budgets.

Note: If your project uses the cost–to–cost invoice generation method, you must include burdened costs in your cost budget and revenue amounts in your revenue budget. Without these

amounts, Oracle Projects cannot successfully generate invoices for your project.

6. Baseline the project budget and funding.

Note: You must fund the budget before you can baseline it.

7. For projects using as–work–occurs billing, generate revenue for expenditure items using the Generate Draft Revenue process.

8. For projects using event billing, enter billing events using the Event option in the Project or Task window.

Note: If you do not want to generate an invoice for a specific top task on your project, uncheck the Ready to Bill check box in the Control Billing by Top Task window. Oracle Projects

assumes you want to invoice all billable top tasks on contract projects.

Hard Limit Processing for Invoices

In Oracle Projects, an invoice is created with all items and events that can be fully billed with

available funding under the hard limit.

• Any items and events that would cause the limit to be exceeded remain unbilled.

• Bill amounts for items are not prorated.

A hard limit prevents invoice generation beyond the amount allocated to a project or task by an

agreement.

For projects funded by hard limit agreements, the total invoiced amount cannot exceed the total

funded amount. A hard limit prevents invoice generation beyond the amount allocated to a project or task by this agreement

Bill Through Date The date through which Oracle Projects picks up events and expenditure items to be billed on an invoice.

Salesperson If you define project managers as salespeople, then this is the project manager of the

invoice’s project. If you do not define project managers as salespeople, this value is blank

Invoice Transaction Type If you choose decentralized invoice processing during implementation, this is the name of the organization that is the invoice processing organization for the project

owning organization. Otherwise, this is the default transaction type of Projects Invoice or Projects Credit Memo based on the PROJECTS INVOICES batch source. You can override the transaction type of an invoice using the transaction type billing extension.

You can also use the AR transaction type extension to determine the AR transaction type when you interface invoices to Oracle Receivables.

An invoice transaction type determines if it is an invoice or a credit memo.

Invoice Number (AR) The number of an invoice that is printed on an invoice, and the number that can be tracked in Oracle Receivables. This number can be system generated, or a number that you

enter which uniquely identifies the invoice in Oracle Receivables, depending on how you

implemented your invoice numbering system in Oracle Projects. The invoice number is

determined when you release an invoice.

Methods of Invoicing

You specify the invoicing method based on the distribution rule that you select for the contract

project. Oracle Projects supports three methods of invoicing:

As-work-occurs

• Based on bill rates or markups applied to detail transactions:

- Time and Materials (T&M) when using bill rates, or

- Cost plus when using burden schedules

Cost-to-cost

• Based on the ratio of the actual costs to budgeted costs and revenue (referred to as percent spent)

Event-based

• Based on the Oracle Projects client extensions calculations or direct user input from externally calculated amounts; for example:

- Automated milestone creation

- Percent progress complete calculations

Percent Complete

You can enter the percent complete for a project or task. Percent completion information is used for

revenue accrual and billing, and for reporting purposes. Oracle Projects does not calculate project

or task percent completion, but uses the percent complete amounts that you enter.

Each percent complete has an As Of Date. When you use percent complete as the basis for generation of draft invoices, the As Of Date is used to determine the current percent complete.

You can enter the percent complete values manually or interface them from the project management system.

Processing Percent Complete Invoice

To calculate the physical percent complete invoice, you submit the PRC: Generate Draft Invoices process. To submit the process for only one project, submit PRC: Generate Draft Invoice for a Single Project. The invoice process performs the following steps:

1. The process calls the billing extension for each project or top task (depending on whether

the project is funded at the project or top task level). The calling procedure specifies

whether it is an invoice calling process and whether the call is made at the project or task

level.

2. The billing extension determines the budget amounts, event amount, existing revenue mounts, funding balance, and percent complete.

3. If the percent complete cannot be determined, then the percent complete used by the

process is zero, the draft invoice amount is zero, and no event is created.

4. The following formulas show how the process calculates the draft invoice amount:

Accrued Revenue = The lesser of A or B

A = Remaining funding balance if agreement has a hard limit

B = ((Budgeted Revenue - Event Revenue) * Percent Complete at Funding Level/100)

- Existing Revenue

Event Revenue = Total event revenue accrued other than revenue amount accrued by

percent complete events

Existing Revenue = Total revenue accrued previously by percent complete events

5. The billing extension creates an event. The description of the event includes the event

type and the formula that was used to calculate the draft invoice amount

An event is an entry assigned to a top task or project that generates revenue and/or billing activity, but is not directly related to any expenditure items.

An event is an entry assigned to a top task or project that generates revenue and/or billing activity, but is not directly related to any expenditure items.